THERE ARE MANY FINANCING OPTIONS AVAILABLE

RESIDENTIAL:

Leases V. Purchase

Leasing programs allow a zero down option and payments, almost all of which require annual increases for 20, sometimes 25 years. The increases are justified due to anticipated electric rate increases. The payment increases are guaranteed, the electric rate increases are projected. Your future home buyer will need to qualify to assume the lease and the tax benefits are awarded to the leasing company. ABCO Solar does not offer leasing for residential solar installations.

Purchase loans are usually a fixed rate with no increases, no prepayment penalties and allow the homeowner to reap the benefit of the Investment Tax Credits.

When considering leasing versus buying a solar array, notice that lease interest rates are usually not stated, just payment amounts. Solar equipment purchase loans easier to qualify for than lease credit requirements, and the Federal Investment Tax Credit (30%) and the State Investment Tax Credit go to the leasing company, not the homeowner.

Home equity loans, signature loans, and other financing vehicles are available through most banks and credit unions.

Home improvements, especially Solar can be financed using an FHA* loan. No equity is required and rates are dependent upon the borrowers' credit. Credit approval can be obtained within 60 seconds via a secure internet portal.

FHA* Title One Loans allow the borrower to pay down the balance of the loan with the tax refund that generates from the tax credits, lowering the payment. Borrowers may not have an existing second mortgage on their home.

*Federal Housing Authority Title One loans are designed for Home Improvements, borrowers may borrow up to $40,000 (OAC) and interest on the loan may be tax deductible. Consult your tax professional.

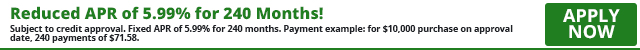

Short term "Same as Cash" financing is available for the FHA program, conventional financing and cash purchases. Ask your ABCO Representative for details.

COMMERCIAL & INDUSTRIAL FINANCING:

Solar arrays can be installed on your owned or leased building.

Commercial loans are available, as are equipment leases for Commercial and Industrial applications. Properly sized, a commercial solar array can stabilize a portion of the utility expense line. Banks and other organizations that specialize in commercial solar financing are available as well as the "relationship bank".

A Solar Service Agreement (SSA) is a vehicle that can stabilize the utility expense line as well as it locks in an electric rate below the local utility rates and can be structured to be net zero from day one. SSA's are particularly useful for Non Profit Organizations that don't need the Investment tax credit, or depreciation available and can yield those to the investors in exchange for a more favorable electric rate. This is a solution where the monthly payment is based on the amount of power used, without the worry about the "budget busting" rate increases.

MUNICIPAL FINANCING

is available for town, city, county, and state government organizations.